Omnichannel Retail Trends 2023

In this report, we explore the biggest technology-enabled consumer trends based on exclusive sponsored research into their expectations and retailers’ ability to meet them.

Download Report

What's Next for Shoppers and Retailers?

Whilst the pandemic acted as a phenomenal catalyst for digital transformation, current economic pressures are testing retailers’ resilience. They are needing to do more with less, and protecting profit margins will be essential in the near term. At the same time, retailers recognize the urgency to continue progressing store digitization efforts to keep up with evolving shopping habits. In fact, more than a quarter (26%) of retailers we spoke to for our 2023 omnichannel survey, told us that ‘upgrading technology and getting a modern point of sale (POS) system is one of their top three business priorities over the next 12 months.

Meanwhile, the consumer appetite for digitally enabled experiences continues to grow. The vast majority (84%) of consumers now research online before visiting a store, primarily to search for the best deals (50% in 2023 versus 40% in 2022) and to learn more about a product or check inventory availability. An overwhelming majority (89%) of consumers are adapting their behaviors in response to the rising cost of living, and it’s clear that many are turning to technology to help them seek better value for money.

Affordability concerns are also hindering the shift to sustainable shopping. Forty-five percent of consumers still consider sustainability a top or essential factor when choosing where to shop, but this is down slightly from the 50% who agreed with that statement last year. In the current climate, frugality trumps sustainability.

In this report, we explore the biggest technology-enabled consumer trends based on exclusive sponsored research into their expectations and retailers’ ability to meet them.

26%

Over one-fourth of retailers we spoke to said that ‘upgrading technology and getting a modern POS system’ is one of their top three business priorities over the next 12 months.

45%

Almost half of the consumers we spoke to still consider sustainability a top or essential factor when choosing where to shop, down slightly from the 50% who agreed with that statement last year.

Survey Methodology

Six thousand adult (18+ years old) consumers were surveyed about their sentiments and attitudes towards the role of the physical store and store associates, innovative fulfillment options, sustainability, inventory visibility, convenience, consistency across channels, and the shift in commerce.

One thousand one hundred and fifty management or senior-level officers in Tier 1 retail organizations (generating more than $100m in annual revenue) were surveyed about their technology-based investment plans to support ecommerce, reduce customer friction, and increase fulfillment options. Respondents represented retailers operating stores and online venues in the following sectors: Beauty; Household Goods and Furniture; Consumer Electronics; Healthcare; DIY and Home Improvement; Fashion; Sporting Goods; and Pets.

Consumer and retailer respondents were based in the following countries: Australia, Belgium, Brazil, France, Germany, Italy, Mexico, The Netherlands, New Zealand, Spain, the UK, and the USA.

* The research findings of this report are based on primary consumer and retailer research carried out via online surveys from March 2023 to May 2023.

Three Key Trends

Trend 1 - The Evolving Role of the Store Associate

Shoppers expect all retail touchpoints to be connected, frictionless, and increasingly personalized.

Trend 2 - The Digital Store 2.0

Retailers have made significant progress in reinventing stores for the 21st century, but it’s clear that more needs to be done.

Trend 3 - Preserving Plant and Pockets

When presenting consumers with pairs of priorities and asking them to select which they are currently choosing, essentially, cheaper ‘everything’ prevails above environmental friendliness.

Trend 1: The Evolving Role of the Store Associate

Shoppers expect all retail touchpoints to be connected, frictionless, and increasingly personalized. In this on-demand era, tolerance for mediocre experiences is unsurprisingly low. It’s no longer enough to just serve the customer; retailers today need to roll out the red carpet.

This is particularly true in non-food retail where staff must continue to surprise and delight the customer, delivering an experience that they cannot get from a screen. Store associates must be armed with the right digital skills and tools to "go beyond" democratizing concierge-level service and redefining customer relationships. Tech-enabled human touch will be the differentiating factor that separates the retail winners from the losers.

The skills required of retail staff will also evolve as artificial intelligence (AI) automates more retail tasks in the future. This will add to the urgency for retailers to rethink the role of their most valuable asset—their frontline staff. As automation becomes more prevalent, retail staff will be able to focus on more valuable, customer-facing tasks, and transition to become genuine brand ambassadors. How should they be rewarded? What skills will they require? How much autonomy should they have? These are all questions that retailers need to start thinking about today.

The most successful retailers are those that are guided by the customer. So, what does today’s customer value most from store associates? According to survey respondents, it’s having knowledge about the product they are thinking of buying (49%), followed by having the ability to demonstrate a product and physically show it to them (24%). Older consumers (55+) are most likely to consider this as the most important aspect of a shop assistant’s service compared to others. Comparatively, younger consumers are more likely to think that having personal experience with products—with retail associates suggesting other products that may go well with what they want to buy or checking stock availability—is the most valued aspect of a store associate’s service of all the age groups.

However, with the importance of more service-oriented behavior falling behind commercially focused activities, retailers could be doing more to enhance the customer experience for those looking to shop in-store. For example, nearly 40% of consumers said that sharing personal experiences of products is the most valued service provided by a store associate. This is not common practice in retail stores today, but we believe there is an opportunity for physical retailers to emulate the early success of similar digital initiatives such as ‘live shopping’. To enable these kinds of authentic interactions, retailers need to be prepared to loosen their grip so that store associates feel empowered to create meaningful experiences for the customer.

As the role of the physical store evolves beyond the transactional, the store associate’s role must also evolve beyond purely assisting the sale. Instead, they must become trusted advisors. This is particularly relevant for categories where the purchase is more considered such as DIY/furniture or consumer electronics, as well as those that require deeper personalization (i.e. health and beauty).

Sometimes, of course, shoppers just want store associates to make their lives easier. In grocery retail, for example, the ability to consistently deliver on the fundamentals—such as keeping shelves stocked and reducing wait times at the checkout—remains critical to a retailer’s success.

Meanwhile, frictionless and connected experiences are becoming the norm in non-food retail. For example, when asking consumers what they would like to happen when they go to a shop and the product is not in stock, the majority said they are most likely to look to the store associate for assistance. Over a quarter (27%) of consumers would like the shop assistant to check if the product is available in a shop nearby, while 23% would like the shop assistant to order the item and have it delivered to their home or in-store as soon as possible.

Similarly, shoppers are increasingly turning to store associates for queue busting, particularly in non-food categories like sports and leisure, pet care, and household goods and furniture. Utilizing mobile POS devices to check shoppers out on the spot has the potential to lead to greater customer satisfaction and, ultimately, increased sales.

Trend 2: The Digital Store 2.0

Retailers have made significant progress in reinventing stores for the 21st century, but it’s clear that more needs to be done. Brick-and-mortar retail must continue to transform to ensure relevance in this digital era.

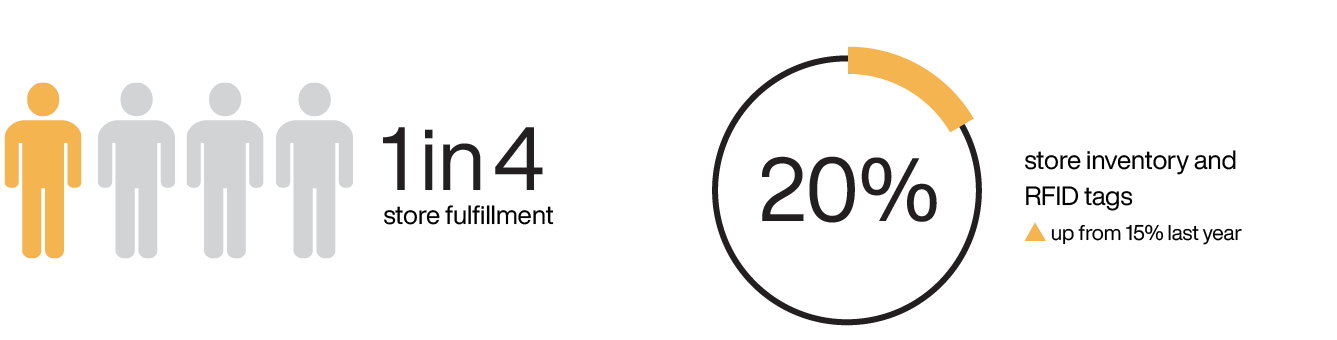

When asking retailers about their business priorities over the next 12 months, it’s no surprise that the most common response was upgrading technology and having a modern POS that manages omnichannel scenarios. Other priorities include store fulfillment, with one in four retailers citing this as a key focus area over the next 12 months, as well as store inventory and radio frequency identification (RFID) tags, which moved up the rankings this year with 20% of retailers calling this out as a leading business priority (up from 15% last year).

In this new era of commerce, real-time inventory visibility is essential. However, retailers told us that they only have an accurate overview of inventory across their business an average of 70% of the time.

And, this varies by retail type; on average, fashion (76%) and sports and leisure goods (76%) retailers report having an accurate overview of their inventory more of the time, while DIY/home improvement businesses report having this view considerably less (62%) of the time. Although the need for inventory visibility is arguably greater in those categories with higher return rates, it’s clear that more work needs to be done across the wider industry.

Greater adoption of RFID tags in retail stores is one way to improve inventory accuracy, helping retailers to simultaneously achieve operational efficiencies and enhance the customer experience. Currently, less than one-third of retailers (31%) are using RFID tags in their stores.

When we asked retailers how their organizations currently or plan to use RFID technology, four in ten were most likely to say stock-related activities—for example, to maintain accurate, real-time counts of inventory (40%) or to locate stock (40%).

The 40-year-old technology could also help retailers to cut friction at the point of sale. Currently, just 29% of retailers have an RFID checkout capability activated on their in-store handheld devices. However, retailers are likely to look to RFID more strategically over the next 12 months to improve the checkout experience as well as analyze footfall trends and advertising strategies.

Just as retailers today allow customers to shop on their terms, they must also let them check out on their terms. Despite all of the recent progress around checkout automation, shoppers overall still prefer traditional sales checkouts. Naturally, this will vary considerably by market, demographic, channel, and shopping mission, among other factors. For example, a whopping 40% of younger shoppers (aged 18-24) prefer to use self-checkout or ‘scan and go’ using a shop device or their mobile compared to just 14% of older shoppers (aged 65+).

60%

Traditional manned checkouts are preferred by 60% of shoppers in markets like France.

52%

Traditional manned checkouts are preferred by 52% of shoppers in Germany.

Similarly, cultural differences and the prevalence of alternative checkout options in different markets will result in varying consumer preferences. Traditional manned checkouts are preferred by the majority of shoppers in markets like France (60%) and Germany (52%) while, in the UK, self-checkout comes out on top.

Overall, consumers are most likely to choose traditional credit or debit cards as their most preferred payment method by far, with just under half (47%) saying this, compared to around a quarter (23%) preferring cash. Despite this, there is still a notable segment that prefers digital methods, such as PayPal (10%) and Digital Wallets (4%).

However, nuances in these preferences exist depending on country and age. For example, German consumers are the least likely to use traditional cards (24%), instead preferring to use cash (41%), while also being the most likely to use PayPal (16%). Meanwhile, other digital options, such as digital wallets (Apple Pay and Google Pay), are most favored in the UK (14%) and Netherlands (12%).

These regional nuances, once again highlight the importance of having the flexibility to meet the varied country-by-country expectations of their customers. Retailers must understand these changeable demographic and regional preferences, and provide choice in both payment and checkout options, recognizing that one size most certainly does not fit all.

Trend 3: Preserving Planet and Pockets

Persistent economic pressures have curbed consumers’ appetite for sustainable shopping. The perception, and at times reality, that green products come at a price premium means that shoppers are deprioritizing these purchases in favor of low-cost alternatives.

When presenting consumers with pairs of priorities and asking them to select which they are currently choosing, essentially, cheaper ‘everything’ prevails above environmental friendliness. The only time ‘environmentally friendly’ (47%) is more likely to be chosen is when pitted against ‘quicker delivery’ (53%). This suggests that consumers are happy to wait for their products, in favor of being sustainable, but crucially they are not willing to pay more for this. In fact, more than half (52%) of consumers consider cost the most important consideration when it comes to delivery, followed by length of time to deliver (27%).

Meanwhile, a mere 8% of consumers rank the impact on the environment as the most important delivery consideration. Although symptomatic of current financial strains, this is also likely due to the lack of transparency and awareness around the environmental cost of home deliveries. Retailers have spent the past decade training shoppers to expect fast and free delivery, regardless of the financial or environmental cost.

The tide, however, is beginning to turn. Some retailers have quietly started charging for delivery and returns, while others have implemented more sustainable delivery options in a bid to decarbonize the last mile. Also, with many retailers now able to provide near real-time inventory visibility, consumers can make smarter decisions about which stores to visit or which delivery options to choose. This simple action can significantly minimize miles traveled and open up a variety of greener last-mile delivery options, which in turn can lead to significant reductions in CO2 emissions.

In the future, we can expect more retailers to allow longer ‘order modification’ grace windows, giving shoppers the option to alter online orders right up to the point a shipment leaves the warehouse, store, or micro fulfillment center. Allowing these last-minute basket edits means fewer split shipments and, in theory, fewer unnecessary returns.

It's important to point out that challenging financial times do not impact all consumers equally. Older consumers are naturally less likely to be affected, with one in five (20%) consumers aged 65 years and over reporting that there is no impact at all. Yet this is the group least likely to consider sustainability when choosing where to shop: over 20% of older shoppers said that sustainability is not important or not a consideration for them when selecting a retailer. This contrasts sharply with the 55% of 18-24-year-olds who deem sustainability essential.

Just as consumers are having to balance protecting their purse strings and protecting the planet, retailers too are striving to achieve operational efficiencies while still progressing the sustainability agenda. Fortunately, these two often go hand in hand: becoming a more sustainable business often delivers significant cost savings and efficiencies. However, when retailers are confronted with immediate challenges such as cost inflation and sluggish consumer demand, sustainability can quickly become deprioritized. Only one in five retailers told us that creating a more sustainable and environmentally aware supply chain (21%) and doing more to minimize the environmental impact of their organization (22%) are within their top three business priorities over the next 12 months.

With environmental and sustainability efforts on retailers’ agendas, how are they building sustainability into their operations strategy? Overall, the likelihood of building the various sustainable strategies into retailers’ operations is relatively evenly spread, with resizing their store network (47%) most likely. However, there is some nuance in strategy between the various countries, for example, New Zealand is most likely to be using warehouse management optimization (63%) and has a clear preference for this and a better management of returns (60%).

Conclusion

Retailers are still obsessing over terminologies such as ‘omnichannel’, ‘blended’, or ‘multi-dimensional’ retail. But we mustn’t overcomplicate things. The fundamental principles of retail remain. Consumers want fair prices. They want good quality and service. They want consistency. They expect to shop on their terms and to have a seamless experience regardless of how, when, and where they ultimately transact. Therefore, retailers must unify their supply chain commerce processes and systems to support the evolving needs of today’s channel-agnostic consumers.

The retail industry has proven its resilience and adaptability after years of varying forms of disruption. As our research has shown, the immediate need for cost efficiencies may be driving decision-making at both retail and consumer levels, but retailers must continue to adapt and invest in technology solutions that enable them to meet heightened consumer expectations.

Instant Access

Download the full copy of the report for instant access to the findings.